An expert physician considers the challenges that arise with ICD10 coding in delivering care for patients with hepatic encephalopathy and risk adjustment.

An expert physician considers the challenges that arise with ICD10 coding in delivering care for patients with hepatic encephalopathy and risk adjustment.

A discussion on the importance of increasing awareness of hepatic encephalopathy for primary care providers/physicians.

A key opinion leader enumerates the unmet needs in the management of hepatic encephalopathy, and provides insight into promising clinical developments.

An expert physician considers how to best adapt care for outpatients with recurrent hepatic encephalopathy.

An overview of the AASLD (American Association for the Study of Liver Diseases) 2014 Practice Guidelines regarding the diagnostic process for patients with hepatic encephalopathy at risk for recurrence.

A key opinion leader considers the physical and economic impact of hepatic encephalopathy on patients.

In times of uncertainty, its crucial for physicians to build a plan to protect their financial future.

How to merge in-person and virtual appointments effectively and efficiently, on this week’s Medical Economics Pulse.

Every human is potentially biased against other groups, but awareness is key to avoiding it.

This issue is just now starting to be addressed by universities.

Not addressing the issue with the entire care staff and create problems for a patient’s health outcome.

Slowing down is the first step to helping patients achieve their care goals.

A doctor’s life experience can negatively affect care for patients.

Marketing your services and engaging your patients has never been more important.

The quick, snap judgements you make about your patients can influence your care decisions and hurt patient outcomes.

Will the lender be looking for personal guarantees using physician’s house or other property?

How physicians can tackle new challenges with EHR systems, on this week’s Medical Economics Pulse

The type of lender will play a big role in how quickly money appears in your account.

Make sure you are on the same page as your lender when it comes to how funds will be utilized.

Be prepared to provide a variety of tax, bank, and payroll expenses.

A myriad of choices can help your practice, but be sure to make the right choice for your situation.

Tax planning tips for physicians, on this week’s Medical Economics Pulse

The second round of loans is taking longer than the first, so plan accordingly.

Congress approved a new round of funding for the Paycheck Protection Program, but the rules for borrowing and using the money have changed. Is your practice eligible?

And what you can do instead.

Make sure you understand how the staffing requirements will affect the loan forgiveness terms.

These low interest loans provide plenty of opportunities, if you follow all the rules.

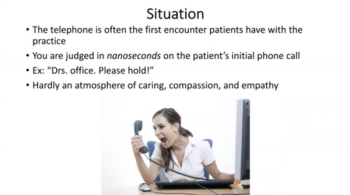

Even in a world of telehealth and virtual care, talking to patients effectively on the phone is a critical skill for physicians and practice staff.

What changes brought on by COVID-19 should stay.