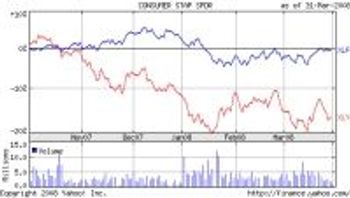

Huge SUVs and pick-up trucks have become the white elephants of the used-car market, with some dealers refusing to take them in trade because they are so hard to resell. You may not want to take on a $100-a-tankful monster either, but that doesn't mean there aren't other bargains to be found in pre-owned cars. In an economy with a bad case of the staggers, car dealers are poised to offer sweet deals to move the metal off the lot.