Compliance to protect patients from unauthorized access to their personal information has not kept up with technology or economic developments in healthcare management.

Compliance to protect patients from unauthorized access to their personal information has not kept up with technology or economic developments in healthcare management.

A New Bull or a Bear Market Rally?

Take control of your financial future by turning off the financial networks, and tuning in to yourself and three simple principles you already know to be true.

The Centers for Medicare and Medicaid Services recently announced new standards that private Medicare plans, known as Medicare Advantage plans, must meet if they want to bid on the Medicare insurance business this year.

With the devaluation of IRA accounts, many people are wondering, "Should we convert part or all of our traditional IRA to a Roth IRA?"

Obama administration is moving to shore up the confidence of potential car buyers with the Warranty Commitment Program, which would ensure that car buyers would still be covered by warranty even if the car makers go into bankruptcy.

The idea behind overdraft protection sounds good. But as more Americans use debit cards instead of writing checks, their grasp on their bank balances is getting looser and the result has been a blizzard of overdraft charges.

The Mazda6 and the Mazda3 are good examples of a traditionally good value; both cars have shown up with excellent reliability, safety, and quality comparable with Toyota.

Giving your old clunker to a charity can be a noble move—but most of the time, you won’t get a big deduction.

Faced with the largest budget deficit on record, the Obama administration is aiming to cut some of the shortfall by boosting revenues. In the crosshairs of the revenue-enhancing push are offshore bank accounts that are used by the affluent to evade taxes.

The veneer of municipal bonds was recently cracked, though they were commonly thought to be ultra safe because of their traditionally rare defaults. Munis can have credit problems that are not appreciated, especially by the individual investor.

For the first time since getting into the walk-in retail clinic business, CVS is closing some of its MinuteClinic sites on a seasonal basis.

The country is headed on a path toward government running everything in our lives. Now is the time to stand tall. Here is a list of practical ideas to restructure your life.

One new credit card gimmick that might reel you in is the affinity card, with its promise that your favorite charity will get a percentage of every dollar you charge on the card.

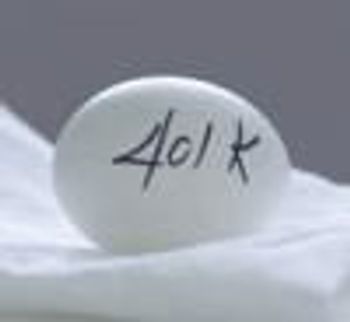

The Solo 401(k) is revolutionizing the way many self-employed individuals save for retirement.

The large declines in global stock and bond markets reflect a lack of confidence in the financial system that has its roots in failed U.S. home mortgages. Credit has become extremely difficult to obtain, as banks unable to sell non-performing assets shun new business loans and hoard cash.

One way parents of potential college students can pay for college tuition is through a prepaid 529 plan. Instead of putting money into a customary 529 plan, where it’s subject to market swings, parents can pay for future college expenses at today’s prices through a prepaid 529 plan.

There’s no question that today’s economy is as difficult as any we’ve seen in our lifetimes. Rising unemployment in recent months is putting pressure on the Obama administration to repair credit markets to spur economic growth and boost the stock market.

Although evidence is mounting that the recession is causing some consumers to postpone medical care or even eliminate it entirely from their budget, there’s one segment of the population that’s hotfooting it to doctors and dentists.

Websites like Zagat�s and Angie�s List, which rate everything from restaurants to electricians, have long been popular with consumers. Now these sites are branching out to include patients� ratings of doctors.

When you think of bartering, the image you might conjure up is of one farmer trading two cows and a horse to another farmer for his prized pig. But, that was then. Today, bartering has become a very sophisticated yet flexible form of doing business, and doctors are active participants.

All through the market’s implosion, you’ve listened to the Wall Street gurus who told you to hang on and stay the course. But now, with stocks at 50% off their peak, you’ve decided the market’s heart-stopping free-fall is bad for your mental health and that it’s time to sell and take some cash off the table.

Did your brokerage go belly-up last year and did your account move to another broker? Did you move your account to another broker because you were worried about whether your brokerage would survive the chaos on Wall Street?

With mortgage rates at historic lows, many homeowners are looking to save some cash by refinancing at a lower rate, a move that can shave serious money off a monthly mortgage payment.

The stimulus package incentives for health IT will double the amount of e-prescribing by physicians and lower drug and medical costs by $22 billion over the next decade.

The largest US financial institutions are on government life support. Smaller banks are collapsing under the weight of plunging real estate values and worthless loans. Other than US Treasury debt, with near-zero interest rates, there aren’t many safe places left to park your savings.

As airlines try to get their revenues off the ground, they’ve started to charge for many services that used to be free. As a result, many travelers now are paying to check luggage, change reservations, and even for the food and beverages they have while in the air.

Whether you call it penny-pinching or belt-tightening, the recession has most Americans taking a hard look at their household budgets to find ways to save.

Obama has indicated that taxes for those making $250,000.00 and above will be higher, probably as soon as 2010.

If you’ve been figuring out how much you’ll owe Uncle Sam come April 15, the bottom line number may come as a shock.