When the stock market is volatile, it's best to avoid panic and avoid major shifts to your strategy. However, those with a bit of a financial cushion may want to explore, cautiously, the possibilities created by the market.

When the stock market is volatile, it's best to avoid panic and avoid major shifts to your strategy. However, those with a bit of a financial cushion may want to explore, cautiously, the possibilities created by the market.

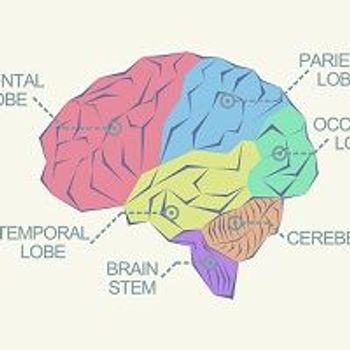

At least 5 million senior citizens fall victim to financial scams in the United States each year. Some are left penniless. New science shows one cause of these poor choices is a specific neurological deficit.

This week's stock market turbulence raised concern among many investors and future retirees. A new study looking at the sexual choices of college-aged males gives insight into the stark differences in the choices people make when in "hot" mental states versus "cold."

This week's stock market drop spooked many investors. However, smart investors know a volatile market is no time to panic.

Just as our hot and cold states can impact our purchasing decisions, so too can these neuropsychological states affect our medical decisions. Here's how.

Neuropsychology contributes to our understanding of why we make the economic decisions we do.

The choice between impulse buying and delayed gratification can have a major impact on our finances. It turns out there's a neurological explanation for this.

The number of physicians experiencing burnout is on the rise. Some doctors report that having a hobby they are passionate about can help reduce the impact of their stressful job.

Indiana cardiologist Irwin Labin, MD, devotes much of his free time to his work as a metal sculptor. He says it provides him with a release from the analytical world of practicing cardiology.

Jeff Brown, MD, is a family practitioner and a popular Physician's Money Digest columnist. But there's more to him than his day job. He's also an accomplished painter and one of a growing number of physicians who are passionate about art.

Art and science are increasingly seen as complementary, rather than opposites. Walter Neives, MD, a neurologist and avid photographer, is a case in point.

Many people in the finance industry, such as financial advisors, are in the pretty position of making money whether their clients do or not. Their clients should remember whose boss and demand good performance.

The investment philosophy of John "Jack" Bogle has a loyal group of followers who swear by his approach. In this interview, one "Boglehead" explains why.

When viewing art, some museum-goers get that loving feeling. They like what they see and they see what they like. A few go so far as to have a religious experience of sorts and report sensations of euphoria. These perceptions, originating in the brain, aren't all that is going on in a museum visitors' body. The area below the neck is also engaged.

Physicians face a seemingly difficult choice of whether to self-manage their expendable income, or whether to hire a financial advisor. A look at the median incomes of physicians and advisors provides some insight.

It could be a dull subject, but someone has to teach children about money. Ideally, that someone is a parent or both parents. Now, though, they have help.

Even the most jaded museum attendee will marvel at the Metropolitan Museum of Art's "China: Through the Looking Glass" exhibit, which comes off like an extravaganza. Here the influence of China on Western fashion is showcased. East combined with West makes dressing more like theater than simply covering the body for the sake of modesty or warmth.

Traveling to Europe can be a fun and rewarding adventure, but if you want to maximize your trip, you need to start out on the right foot. Follow these rules to optimize your journey.

Collecting can satisfy a number of needs, from social interaction to intellectual stimulation. A new study sheds light on the economic value of the practice.

For some living in Manhattan, it is easy to think that the "Fordham University" just south of Lincoln Center is Fordham University. This is wrong. Though the university's performing arts center is located near Lincoln Center, the entire university is so much more.

Most people don't even know what complex securities are, much less invest in them. If you are in that category, you may be in a better position than those that do.

Most visitors to New York City visit the Metropolitan Museum of Art or the Museum of Modern Art. Fewer people visit the Museum of Art and Design, better known as MAD. In failing to notice, visitors miss one of the best museums in the city.

Buying penny stocks is not for the faint of heart. The occasional extraordinary gain is overshadowed by the enormous risk not only inherent to the stock itself but also due to other factors.

When visiting crowded and bustling Manhattan, it can be refreshing to escape the crowds and still enjoy a first class exhibit with pizazz. That is what the Hispanic Society of America has to offer.

There is no guarantee that those who pay for long-term insurance will receive a benefit. Self-insuring is a better option for many.

New York City auction houses were humming during Asia Week in mid-March. The buzz, however, was not due to English being spoken as in the past. It was Mandarin and Cantonese that was producing the background din.

With the stock market high and profits generous, some Long-term Care Insurance (LTCI) vendors are suggesting that investors take money out of the market and buy the insurance they offer. Though it is true that this might be a good idea for specific groups, for others it is not what they think nor will it be worthwhile.

President Obama has publicly stated that he is against excessive and hidden fees for retirement accounts. This is important because if fiduciary rules for retirement plans are not altered, a segment of America will have little in their old age returned to them from these accounts.

Many investors looking for an advisor tend to choose someone who makes them feel the most comfortable. That may be human nature, but it's not necessarily the best strategy.

Fifty percent of Americans cannot correctly answer 3 basic financial questions relating to interest rates, inflation, and risk. Can you? If not, you need a financial advisor.