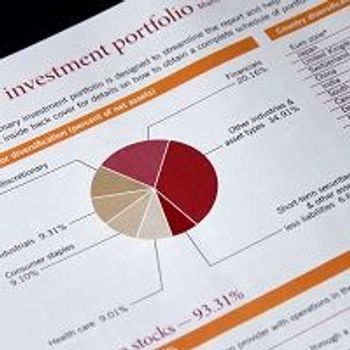

In general, working with a financial advisor is a great idea for physicians. However, there's also danger in turning responsibility for your investment portfolio over to someone else.

In general, working with a financial advisor is a great idea for physicians. However, there's also danger in turning responsibility for your investment portfolio over to someone else.

Index funds have become popular for good reason. Just don't think of them as some sort of cure-all for every portfolio.

The bombing of a Doctors Without Borders hospital in Afghanistan earlier this month continues to be in the news. Political ramifications aside, the bombing, which claimed the lives of 22 doctors, nurses, and patients, raises anew concerns about the risks that physician face when traveling overseas to volunteer.

Online scams are common, and they can be dangerous. But vigilance, good password protection, and taking immediate action to address the scam or spam is a solid defense strategy.

The best way to break out of inertia – whether it's financial, professional, or personal – is to get moving, but how can you get started when the list seems a mile long?

Passwords are like an online house key; they must be kept secure at all times. They should also be changed fairly frequently.

A financial advisor can be a key factor in whether or not you achieve your long-term goals. But before choosing an advisor, it's important to know what professional standards they hold themselves to.

Junk e-mail, phishing scams, and malicious e-mails make up a staggering proportion of the average person's inbox. Follow these do's and don'ts to keep your computer, and your finances, safe.

Designating beneficiaries can be a simple act, but it also requires regular upkeep as life circumstances change. Here's a list of items to consider as you prepare and update your estate plan.

If you're an impatient type, saving for the future can be a difficult proposition. These simple steps can help you beat your impatient financial instincts.

I consider myself a very aware consumer, so I was surprised when very recently, I was the target of a minor but relatively sophisticated online scam. (No, I didn't front the Nigerian prince several thousand dollars in return for millions once his fortune was released.)

As a physician, you are intimately familiar with what it's like to serve others. So, when your career winds down, will you miss that aspect of your life? You don't have to.

Complexity has a way of seeping into portfolios a little bit at a time. Simplicity has advantages beyond being easier to understand: it's also likely to keep you disciplined and adherent to your goals and long-term strategies.

Casual investors often neglect to rebalance their portfolio. While rebalancing may seem a trivial thing to some, or one of those distant "when I get around to it" things, it shouldn't be.

Options can be risky and complicated, but they don't have to be either one, and they can potentially bring a high return.

While near-retirees may plan to travel, play golf, and perhaps take up sailing, lifestyle surveys of what retirees actually do shows activities that can be just as diverting, but on a smaller scale, and with much less of a budget.

Divorce can have a huge emotional toll, but it can also have a major impact on your financial picture. Here are some things to keep in mind if you are going through the process.

How prepared you are financially may be a big determinant of how satisfied you are with your post-career life, but it will not by a long shot be the only factor.

Spending is easy. Saving is harder. Investing may be hardest of all, because it's not just squirreling money away, it's actively learning how to make it work for you, a process that takes time and effort.

Many myths are harmless, but believing the myths surrounding retirement can be financially devastating.

Investing-particularly for your retirement -- is generally a long-term endeavor. But every portfolio also needs it share of liquidity.

Diversification isn't done to grow your investment, and it won't guarantee against losses. But it will provide a layer of safety to your portfolio.

When most people think of investing, they think of buying stocks or setting money aside in an environment account. However, there are a number of less-common, and riskier, investment vehicles you might consider.

When many people think of working with a financial advisor, they think of millionaires, inheritors, or lottery winners. But financial advisors aren't just for the very rich.

One of the key obstacles to a good saving and investing strategy is accumulated debt. Debt can impact healthcare professionals of all ages and at all stages in their careers.

There are better, more interesting investments than savings bonds. But the tried and true investment does have its advantages.

No one knows where exactly the stock market is headed, but a sound financial strategy is the best way to counter whatever turns the market takes.

Career stress. Parenting stress. That old fear that you've missed the entire semester of class and the final is today. According to survey after survey, including last year's Gallup Economy and Personal Finance poll, all of these are dwarfed by financial concerns.

When it comes to investing, inertia can be your worst enemy. These four tips will help you get the ball rolling on your retirement savings.

Let's face it: Most of us would like to be immortal. Anything that reminds us of our own mortality is more likely to be put off than the biannual cleaning of the gutters. But there are certain things you need to confront to put your financial house in order before your time comes.