In this fast-paced global economy and complex tax system, professional advice is almost always worth the cost.

In this fast-paced global economy and complex tax system, professional advice is almost always worth the cost.

Since TIAA-CREF stock funds are generally higher in expense than other low-cost options, conducted studies have important implications to clients.

Front office staff are the face of a practice. Patients form perceptions about the quality of a doctor’s work based on interactions with staff at the front desk. As such, the people you hire as front office staff might just be the most important staff members in the practice.

It's essential that he/she choose an attorney with substantial experience in the process who knows how to challenge the other party’s financial expert.

It’s important to choose a highly experienced attorney in representing physicians when it comes to divorce.

Ensure fairness across generations by choosing the right annuity or life insurance distribution method.

There are different ways to invest in real estate, each carrying different inherent levels of risk, liquidity and transparency.

Look for charities that are efficient, effective and innovative. Use tax-smart strategy and stay clear of crowdfunding scams.

Despite watching the market rise, the bigger issue with transitioning your portfolio to cash is that, when trying to time the markets, you must be right twice.

Doctors have been collectors and artists for centuries, expressing their artistic side even though they're trained as scientists.

Non-clinical careers are different than non-clinical jobs and it's important to consider the difference between these routes in searching for a career transition.

Excellent recordkeeping and policy handbooks are the heart of any practice. Too often, thorny situations arise without proper documentation, but potential lawsuits can be avoided with the aforementioned elements in place — maybe it’s time to have a conversation with a human resource professional or labor employment attorney.

If the bull market has skewed your asset allocation, fixed-rate annuities or fixed indexed annuities can help.

In order to assess your true risk tolerance, take the same approach you do with your patients, one that’s based on outcomes.

You may be surprised which will cost you more over the long run. Donating 10 percent of your income or paying a 1% management fee on your investments.

Should you focus on paying down student loans after residency or invest? The author of the blog Another Second Opinion weighs the options.

Nearly two decades ago, Shirley Mueller and her husband invested in their granddaughter's future under the Uniform Gift to Minors Act (UGMA). The physician turned financial advisor assesses the present and future outlook of the contribution.

Regardless of the stage of a physician’s career, he/she should remember the importance of learning new ways to practice medicine reaffirming the important current competence.

Cut out the middleman and pay yourself instead — but look before you leap.

Death is an inevitable part of life, and it can happen at any time. Though you may not be ill or expect it to come, death does not cater to our plans. That's why it's important to make sure your assets are taken care of in the event something happens to you. Continue below for crucial estate planning tips.

More and more physicians are exploring medical careers outside patient care. Even if you're still passionate about your clinical work, it is never a bad time to move forward toward new challenges and skills. Continue below to see if a non-clinical role is right for you.

While cabins, condos and cottages can be expensive consumption items, our second home purchase was actually a great investment.

Take advantage of these four ways to boost your real estate returns.

According to the AAMC, 83 percent the class of 2016 left school with more than $100,000 in debt. If you are like the majority of medical school graduates out there, you're probably saddled with a good amount of student debt. Of those students, 44 percent plan to enter a loan forgiveness or repayment program. Consolidating and refinancing are just two of those options. To learn about these two payment plans, continue below.

As health care professionals committed to ethics, it may not occur to physicians that their financial advisors don't adhere to the same principles. Advisors serve the best interests of their clients, and if you are not on top of the nuances of the financial advice industry, you may find yourself in a conflict of interest. Continue below to learn more about finding advisors who care as much about ethical practices as you do.

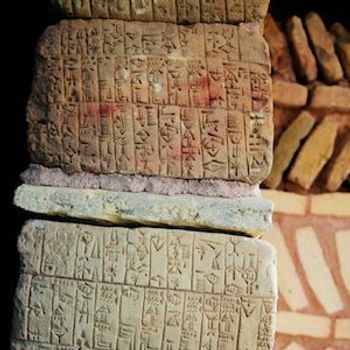

Hobby Lobby: Nipped by a bargain, or something worse?

The pros and cons of single family vs. multifamily real estate investing.

Important considerations for physicians looking to make the switch.

After ten years in practice, I'd like to take the time to pass along some advice to a younger version of myself.

Though jobs for physicians are plentiful, they still need to know how to network.