If you’ve ever played blackjack, you know that at certain times you can double down on your original bet. Unlike the table games in Vegas where it could take seconds, doubling the value of your portfolio can take many years.

If you’ve ever played blackjack, you know that at certain times you can double down on your original bet. Unlike the table games in Vegas where it could take seconds, doubling the value of your portfolio can take many years.

You don’t have to be a math whiz or use fancy spreadsheets to understand many parts of your personal ï¬nances. Sometimes it’s just a matter of elementary school math: basic addition and subtraction.

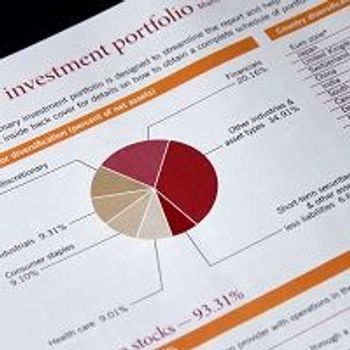

Take a big-picture look at all of your investments. Do you see a clear strategy, or is it investment chaos? Here's how you turn the chaos into harmony.

To truly take charge of your finances, you first must have a realistic snapshot of where you stand. This guide will help you accomplish that goal.

There's still time in 2015 to take advantage of financial moves that can start you off on the right track in 2016.

Physicians are the most generous people in this country: we provide medical care day and night to millions of people – often for free. If that forced charity isn’t enough for you this holiday season and you’ve got more money to spare before your next estimated tax payment, here are five simple methods to lighten up your wallet even more.

One key principle of successful investing is to diversify your portfolio as broadly as possible to minimize the risk that any one speciï¬c investment will crush you. Many physicians extrapolate that concept to mean that they should hire more than one ï¬nancial advisor. That usually creates more problems not more sophistication.

Recent headlines about the stock market probably made the hairs on the back of your neck stand up. But a wider view makes clear there's no need to be spooked.

Generally it's to your advantage to choose a Roth account over a traditional account if you think that you'll pay higher taxes when you withdraw the money than you do now. These four methods can help you get there.

At some point you may have thought "Should I use a Roth account for my investments? If so, how do I do that?" In this first of 2 stories on the topic, Setu Mazumdar, MD, CFP, discusses possible Roth investing strategies.

Sometimes it's actually in your best interests to pay more taxes. Here are 3 reasons why you might want to up your already lofty tax bill.

Doctors are highly educated, yet many "cry like babies" when they're challenged about their personal ï¬nances. Here are 3 lessons doctors can learn based on common financial complaints.

People sometimes get lazy, and that's not necessarily a bad thing. For instance, there are certain areas of your investments that don't benefit from too much focus.

Despite having one of the highest-paying jobs in America, physicians are never happy with their income. The problem with physician income statistics is they don't take into account some very important contributing factors.

Certain financial attitudes can be detrimental to you financial health, but one can catapult you ahead of your peers. Which attitude do you have?

If you don't care about your hard-earned money, then go ahead and "invest" in financial products that are designed to solve a problem that doesn't exist.

Could cutting down work hours actually result in a larger retirement portfolio down the road? It may seem unlikely, but overworked physicians might be surprised if they do the math.

If done properly, diversification reduces risk in a portfolio and potentially generates a higher rate of return. But there is one type of diversification that does not fit with an investment plan.

There are only a few right ways to manage an investment portfolio and many more wrong ways to do so. Be wary of advisors luring you in with promises of high investment returns and low risk.

Having lost faith in the stock market after the 2008 financial crisis, one physician put all his money into a commodity trading advisor contract.

Real examples of foolish investment and financial strategies physicians have tried and learned their lesson. Remember: if it's too good to be true, it probably is.

Most doctors would walk away from medicine if they had the means. And when you get your financial life in order, you'll be able to quit, if that is what you want to do.

Many physicians keep working longer and harder because they did not get anywhere near the type of market returns they should have over the last several years.

The past several years of returns have been among the best we've experienced, but many physicians aren't seeing it reflected in their portfolios. Here's a look at how an early-, mid-, and late-career physician should have done.

Many doctors have delusional financial thoughts, including the belief that medicine is a safe career that will always provide a decent income. Hopefully, you realize the truth.

Physicians who are sued in a medical malpractice case always lose no matter what the outcome. There's only one way to successfully fight back.

The majority of physicians are not in the top income tax bracket, which means they probably aren't making as much income as they should. So how can you fix this?

Although physicians spend longer on their education and are held responsible for much more than most people, the government, hospital systems, and insurance companies don't consider physicians anything special.

Many physicians are constantly fooled with their finances every day, and the consequences are pretty serious. Take this 5-question quiz to see how you are doing.

Physicians get shafted out of money by patients, the government, and the insurance industry. Give yourself a chance to make working optional so you don't have to "shut up and put up" if you don't want to.

Published: June 27th 2014 | Updated:

Published: October 21st 2015 | Updated:

Published: March 10th 2015 | Updated:

Published: April 10th 2013 | Updated:

Published: November 27th 2013 | Updated:

Published: August 23rd 2014 | Updated: