Article

Your 1040: Negotiating the maze

Throughout the form, there are hot spots for savings, but also easily overlooked danger zones. Here's a guide to finding both--and handling them properly.

Cover Story

Your 1040: Negotiating the maze

Throughout the form, there are hot spots for savings, butalso easily missed danger zones. Here's a guide to locating bothandto handling them properly.

By Brad Burg, Senior Editor

If they were to make the tax code into a moviewe'll bet you canhardly waitit wouldn't be just We Know What You Deducted Last Spring.No, there'd be a touch of Pokemon, too, because the rules are full of scarytraps as well as friendly breaks. Heed both, and you might save plenty ofmoney. But you've got to pay close attention.

For example, you may have heard that an old favorite of doctorstheoffice-in-home deductionwill apply to many physicians again, thanksto a rule change. But before you grab for it, watch out. With taxes, a pennysaved might be a dollar lost. "In many cases, the deduction isn't actuallyworth that much," says CPA Thomas Ochsenschlager. "Moreover, itmight actually cost you money in the long run, by cutting into your capitalgains break on a home sale."

Such surprises aren't rare. In fact, you might consider the 1040 as akind of "Where's Waldo?" for grownups, with a twist. On everypage, one or more breaks may be hiding in plain sight. Unfortunately, theirevil twinspossible trapsare often lurking, too.

Think foreign tax credits are only for big spenders? Or that you don'tstand a chance of qualifying for a medical deduction? Or that first-yeardeductions on autos are limited to $3,060? Then read on as we offer sometax tips you may not know about and address some costly misconceptions.

A. An inheritance windfall is tax-free . . . sometimes

Got an inheritance last year? Since those aren't taxed, you may assumethe windfall is all yours. But if part of the money came from a traditionalIRA or qualified retirement plan, you're not quite so lucky: That portionis taxed (on the 1040's line 15b). Reason: The money that went inwas probably pre-tax earnings, observes CPA Andrew Pfau. "And sincethe money wasn't taxed going in, it's taxable coming out."

Sometimes after-tax contributions also have been made, which can complicatethe calculations, since those contributions aren't taxed now. In any case,all pre-tax contributionstogether with the investment growth on thewhole pileare subject to income tax, even if the money's originalearner is gone. You inherit that tab, too, and failing to pick it up couldresult in a nasty penalty.

B. Psst: Take this deduction even before you qualify

Perhaps you changed practices last year and had to move. Chances are,your new group reimbursed some moving costs, but you may have paid someyourself. You might have heard that you can't deduct those expenses untilyou've put in enough workweeks during the 24 month-period after the move39weeks if you're an employee, or 78 weeks if you're an owner. So you'd haveto wait for that writeoff.

Wrong. You can go ahead and take the deduction on line 26.

"That's permitted, if you expect to meet the workweek requirementwithin two years," says CPA John V. O'Connor Jr. But what if you moveagain, before doing that? You can amend this return or, more simply, addthe deducted amount to the income you report on a future return. Note, though,that you can count only a mover's bill and your transportation and lodgingcostsno earlier house-hunting trips or other expenses.

C. Divorced? Check those tricky alimony deduction rules

If you made payments to an ex-spouse last year, think twice before deductingthe full amount on line 31a. You can't count child-support payments or thosemade under a split-up of assets. "Sometimes, doctors are stunned tolearn these rules, because they've heardcorrectlythat alimonyitself is deductible," says CPA Kevin M. Burkart.

But check every item, because the rules can also work in your favor.For example, you can deduct payments made toward your ex's mortgage andreal estate taxes, if those payments were treated as alimony in a court-sanctioneddivorce agreement. The same rule can apply to medical billsand you'dbe wise to include them here, rather than with other medical deductionson Schedule A. Limitations on that schedule often effectively exclude suchdeductions, for most doctors. Here, though, every deductible penny counts.

D. Day care costsincluding day camp feesmay be worth plenty

Did sending a child to day camp allow your spouse to work? Or did youspend money on day care, for the same reason? When the children are youngerthan 13, such costs can be more valuable at tax time than you realize, thanksto the dependent care credit.

True, this credit is restricted, mostly by income. For doctors, the maximumcredit likely will be 20 percent of actual expensesand only $2,400worth of those count for one child, or $4,800 for two or more. So the largestcredit possible is $960. But at least this is one of the few credits thatdon't phase out completely at higher brackets.

Moreover, remember that a credit reduces taxes dollar for dollar, soit's a lot more potent than a deduction, which just cuts taxable income.In the 39.6 percent bracket, $960 entered on line 41 is the equivalent ofa $2,400 deduction.

As always, though, beware the fine print: Sleep-away camp costs don'tcount, but the nontuition expenses of boarding school do.

E. Do your funds invest overseas? Don't miss this break

Maybe the "foreign tax credit" on line 46 sounds like somethingthat only big spenders could take advantage of. Not true. You may well ownmutual funds that invest in overseas companies. And when you live in onelegal jurisdiction and have an interest in a business located elsewhere,you and the business might be taxed on the same income, by two governments.To avoid such a double tax, the IRS allows you a credit for tax dollarspaid to foreign governments.

"You can find the appropriate figures in year-end mutual fund statements,"says CPA Sherman Doll. The fund company should also supply the informationon Form 1099-DIV, in boxes 6 and 7. If the amount involved exceeds $600on a joint return or $300 for an individual, Doll adds, you have to filea special form providing details.

It's worthwhile to stay alert for this potential credit. Today, it'snot surprising to find that a high-tech fund holds stock in companies basedin Singapore, Hong Kong, or New Delhi, for example.

F. Don't pay both parts of this tax

Half of Social Security and Medicare taxes are paid by employers, andhalf are paid by employees. So if you work for a typical corporate practice,it pays half, takes a deduction for that payment, and withholds the otherhalf from your pay.

What if you're a sole-proprietor physician, though? On the 1040's line50, you must pay both sharesthe employer's and the employee's portionsasa "self-employment tax," but then you get to deduct half thatamount on line 27.

And don't be misled by the term self-employment tax, cautions AndrewPfau: "You may not think of yourself as self-employed if you're anactive partner in a business, like a practice partnership, but for tax purposes,that income is treated as self-employment income on your 1040." Solike a sole proprietor, you'd take the self-employment deduction, too.

G. You may have medical deductions you never expected

Medical costs aren't deductible unless they exceed 7.5 percent of youradjusted gross income, a calculation you make on Schedule A. That test isn'teasy to meet, but look carefully before you give up.

Say you're paying a parent's nursing home bill. Though much of that goesfor room and board, not medical care, you can probably deduct the full amount.This is permitted if your parent entered the home primarily to receive medicalcare and also qualifies as your "medical dependent" because youpay more than half that parent's total support expenses for the year. That'sokay even if Mom or Dad has enough income to prevent you from claiming adependent exemption on your return.

And other medical deduction rules might surprise you, too. For example,if you participated in a quit-smoking program or had drugs prescribed tokick the habit, you can now deduct those expenses. That rule began with1999 returns. However, the IRS says you can apply the new rule to earlierreturns, too, by amending them. Generally, you can go back as far as threeyears to amend returns.

H. Are home loans deductible? Don't count on it

Perhaps you took out a home equity loan in 1999let's say it wasfor $85,000and used some of it to pay down a car loan and credit carddebts. You may have assumed a home equity loan's interest is always deductible,or maybe you've heard it's deductible for loans up to $100,000. But therule is more complex, and it has two parts. First, you must look at yourearlier "acquisition debt"your loans to purchase your house,remodel, or add to it, and any money borrowed to refinance those amounts.

Say your total acquisition debt was $210,000, and the market value ofyour home is $300,000, a difference of $90,000. You can deduct the interestonly on home loans of up to the amount of that difference, subject to thesecond provision: The overall cap on home equity loans is $100,000 ($50,000for singles). Since your loan is only for $85,000, the interest on it isfully deductible here on line 10 of Schedule A, regardless of how you usedthe money. Moreover, this applies to a loan on a second home, too.

And what if you have a line of credit? Better review the deal to seeif you've pledged your main home or a second home. If you have, then yourline of credit essentially is a home equity loan. "In that case, thesame rules for deductibility apply," says CPA Jerome R. Glickman. "Butthe situation is different if you haven't put up that security. And sometimesphysicians miss that distinction." With no home pledged, you'll haveto qualify in some other way (such as by using loan proceeds for investmentpurposes) to preserve the deduction for credit-line interest. Moreover,the rules above differ if you're subject to the Alternative Minimum Tax,Glickman cautions.

I. A doctor-employee might use a soloist's tax form

Schedule C is the form for sole proprietors, so you can skip that pageif you're an employee of your corporate practice, right?

Not so fast. "Schedule C is sometimes the simplest place to accountfor payments made to you individually," says CPA Gregory Goergen. Saya hospital pays you directly for being on call, but your agreement withyour corporate employer requires you to turn over all your professionalincome to it. You could create a "nominee" 1099 formwhichis what you do when you receive money but pass it onto show that you'veturned over the money to your corporation. "But you have to file 1099swith the government by a certain due date, and that's not always feasible,"Goergen explains. The deadline is Feb. 28, or March 31 if you file electronically."So it's often simpler to take a Schedule C, enter the payment as incomeon it and, at the same time, deduct the full amount on line 27 as a paymentmade to the corporation."

J. Automobile writeoffs have taken a few new turns

If you've leased cars in the past, you probably knew you had to baseyour deduction for professional auto use on actual costs on Schedule C.But did you know that restriction is gone? In fact, starting in 1998, taxpayerswith leased autos have had the option to base the deduction on mileage,instead.

For many doctors, using actual cost figures produces a higher deduction,but not always. If you live in a state with relatively low insurance andleasing costs or you do a lot of business while

driving, those miles may put you out ahead. So you'd use line 10, not line20.

In any case, if you go the mileage route, be careful to heed the quirkyrule for 1999. "For the first three months, the mileage allowance was32.5 cents per mile," says CPA Ron Knueven. "But for the restof the yearand this never happened beforethe rate dropped, to31 cents a mile."

K. Schedule D can be a happy hunting ground for breaks

Most doctors' transactions concern two basic capital gains rates: 20percent on property held longer than a year ("long-term property")and ordinary income rates on other property ("short-term property").But one special case could save you thousands in taxes.

Say you inherited a big chunk of blue-chip stock last year, which theexecutor valued at $90,000. But the stock seemed stodgy compared with Internetstocks, so a few months later, you sold it for $100,000 and put the moneyinto high-tech holdings. You knew that when you inherit, you get a "step-upin basis"you count gain only from the time you inheritsoyour taxable gain was just $10,000. Since you held the stock short term,however, you figured you'd owe ordinary income tax of almost $4,000 on that(assuming you're in the 39.6 percent bracket). But a sale of an inheritanceis automatically treated as long term, so you owe only about half that much.

Moreover, you can boost your tax savings by making sure to list someother gains here on Schedule Deven if you didn't individually sellany other holdings in 1999. "When mutual funds make capital gain distributions,sometimes people count those in with dividends, because they think of theprofits from funds as 'investment earnings,' " notes John O'Connor."And then they miss using the lower capital gains rates."

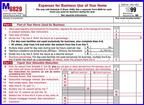

L. Heavy cars may carry more weight on that depreciation form

Depreciation is complex enough to have its own territory within the returnForm4562and complex areas are often where exceptions pop up. Here's onemany doctors find helpful: The usual rules for depreciating autos say youcan't write off more than $3,060 the first year, but you can throw thoserules out the window if you own a sport-utility vehicle weighing over 6,000pounds.

"For those, general depreciation rules apply with no specific autocap, and often you can write off 20 percent the first year," says CPADenise Milner. So say you have a $35,000 Suburban, and your business useis 80 percent. Your first-year deduction could be 20 percent of that, or$5,600. And you might add an explanatory note, in the part of the form wherecar depreciation is normally entered.

M. The home-office writeoff comes home again

Besides seeing patients at your office, you may spend hours each weekdoing administrative, managerial, and research work at home. In recent years,you couldn't get a writeoff for a home office limited to such uses if youhad office space available elsewhere. One physician lost a Supreme Courtbattle over this. But the rule was broadened again for 1999, so you cannow deduct a percentage of household expenses, calculated on the percentageof your home's floor space that your home office occupies.

You'd have to gather a lot of figures for the special form (8829). Still,considering how effective and commonplace home offices are now, you mightlook into this. But check the rules carefully: You must be doing specificprofessional work that you don't do elsewhere. Also, the space you basethe writeoffs on must be exclusively used for such work and "separatelyidentifiable," says the IRS (though you needn't literally partitionoff the area). And the deduction might not be substantial, since the spaceinvolved won't be a big percentage of large homes, notes CPA Bert Tobia.

Not only that, but taking the writeoff might backfire later on, warnsThomas Ochsenschlager. "A portion of your house will no longer be partof your primary residence for tax purposes, which will cut into the amountyou can exclude from gain on a house sale," he says. And that exclusionis substantial: $500,000 on a joint return, $250,000 for an an individual.Also keep in mind that if you're an employee, you'll take the home officewriteoff

on Schedule A, where higher-income doctors lose much of their deductions'value through various phaseout rules. "You definitely must run thenumbers to see if it's worthwhile," Ochsenschlager says.

Thanks to the following CPAs for their help with this article:

Leonard Bailin, Leonard Bailin, PC, Great Neck, NY

Kevin M. Burkart, Burkart and Co., St. Petersburg, FL

Sherman Doll, Thomas, Doll & Co., Walnut Creek, CA

Jerome R. Glickman, Shechtman Marks Devor & Etskovitz, Philadelphia

Gregory Goergen, Professional Service Consultants, Arlington Heights,IL

Ronald J. Knueven, Clayton L. Scroggins Associates, Cincinnati

Denise Milner, Healthcare Management & Consulting Service,Bay Shore, NY

Thomas Ochsenschlager, Grant Thornton, Washington, DC

John V. O'Connor Jr., O'Connor & O'Connor, CPAs, Albany, NY

Andrew Pfau, Martin Klein and Co., New York City

Ken Powell, David Berdon & Co., New York City

Bert Tobia, Tobia and Hillyer, Fairfield, NJ

, . Your 1040: Negotiating the maze.

Medical Economics

2000;3:182.