Article

What to expect from an adviser

Your Money

Are your expectations realistic? Since relationships are a two-way street, let's look at what you legitimately have a right to expect, what's out of line, and how you can help the relationship thrive. Here's what your adviser should provide:

Concrete information in your initial meeting. In most cases, your get-acquainted session should be free. A prospective adviser should give fairly specific answers to your questions, although his replies may encompass a range (i.e., "your returns should be from 6 to 10 percent, depending on your risk profile") rather than a come-on ("we'll talk about that after you become a client"). He should describe how you'd work together; how he's compensated (commissions, fee-only, retainer, etc.), and name some of the investment companies he favors.

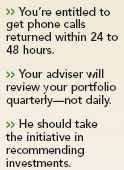

A quarterly review and regular updates. Some clients think a financial adviser should check their holdings every day. Not so! The market dips and climbs constantly, and only long-term returns count. As a client, try to adopt a longer-term perspective, and don't doubt your adviser's ability based on short-term market gyrations. A sharp adviser should review your portfolio every three months and at least note any extreme aberrations or red flags.

Resources for financial education. Your reaction may be, "Why should I learn about finance? That's what he's for!" Even if you're using an adviser, you should have at least a baseline knowledge of investing, so that you understand the reasoning behind his or her recommendations. Some advisers distribute a quarterly newsletter or suggest books, newspapers, or websites to help you learn.

I run periodic seminars to educate clients or their spouses, as do many other advisers. At the other end of the spectrum, some advisers function more like accountants, and simply give you the numbers.

An overview of your entire financial picture. All of your finances-assets, investments, tax situation, etc.-work together to achieve your financial goals. Your adviser should be able to consider every aspect when making decisions or answering your questions. He may need to contact your accountant or tax attorney, but he should have the expertise to deal with that information.

Responses to your questions within a reasonable time. You want to feel that your adviser isn't too busy to talk to you or respond to your e-mails. At the very least, he should have a knowledgeable staff member get back to you fairly promptly.

From your end, give your adviser 24 to 48 hours to return a call, unless it's an emergency-and if it is, make sure the person taking the message realizes that. If you're not getting return calls because you're a small-potatoes account with an adviser who focuses on huge clients, consider switching advisers.

Proactive strategies for your financial health. An adviser should assess your needs and consider opportunities for you even if you don't ask. He should be doing due diligence and evaluating your financial position enough to know whether your goals and your financial resources are in rough balance.