Article

Wake up that sleepy bond portfolio

No matter what your age, you canand shouldbe more aggressive with your fixedincome holdings.

Wake up that sleepy bond portfolio

No matter what your age, you canand shouldbe aggressivewith your fixed-income holdings.

By Jonathan Burton

The author, a West Coast-based freelance writer, specializes in personalfinance topics.

Are you lavishing all your attention on the stock portion of your portfolio?Do you think bonds are safe and simple, a set it-and-forget-it investment?If so, bonds probably aren't doing for you what they should.

Some bonds--such as US Treasuries and high-quality munis--really aresafe and simple. But their safety comes at a price: lower yields. Today,no matter what your age, it makes sense to be aggressive with bonds, becauseyou can earn a lot more in exchange for just a bit more risk.

Yes, but how much risk is too much? What types of bond investments canrev up your portfolio? And how can you spot potential problems? Read on.

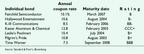

Junk bonds: Still a gamble, but less so now

Junk bonds as well as high-quality corporate bonds can provide totalreturns on a par with those of stocks. Some junk bonds pay more than 11percent annually, and when the issuing companies do extremely well, thebonds' underlying prices can rise. In combination with the dividend, thisprice appreciation provides an impressive total return.

Granted, high-yield junk bonds carry a greater risk of default than thosefrom more stable issuers. But that risk is about half what it was almosta decade ago, when one in 10 junk bonds tanked.

By owning aggressive bonds, you can even lessen your portfolio's volatility.Risky, high-flying bonds can do that? Yes, because different bonds respondto different triggers: Government-bond prices fluctuate with interest rates.Tax-free municipal bonds--best suited to taxable accounts--are tied to stateand local economies. High-yield and high-quality corporates trade more inline with stocks.

And if you intend to live off this income through retirement withouttouching principal, the safest fixed-income investments, such as Treasuries,may be less benign than you realize. "By opting for bonds that carrylittle or no risk, people inject more risk into their portfolio,"says Albert Zdenek Jr., a Flemington, NJ, financial planner and investmentadviser. "They risk not producing the return they need in retirement."

How much to invest in aggressive bonds

These are the good old days when it comes to owning relatively riskybonds. * The economy is doing well, and interest rates are reasonable. Companiesthat issue these bonds benefit from the resulting climate because it's conduciveto growth, which makes them far more likely to pay off their debts.

Because of this, if you're 40 to 55 and a fairly aggressive investor,you'd be smart to have as much as one-fourth of your bonds' allocation injunk (rated BB or lower) and another fourth in investment-quality corporates(rated BBB or better). If you're 55 or older, you might want smaller proportionsof these types of bonds.

Al Zdenek, however, has a 70-year-old client who's comfortable with alarge proportion of relatively risky bonds, even in retirement. The client,a cardiologist, has a net worth of $5.5 million, and his living expensesrun a sizable $20,000 a month. To enable the doctor to live off the portfoliowithout touching principal, Zdenek directed about $1.8 million into low-qualityand investment-grade corporate bonds. About $800,000 more went into convertiblecorporate bonds, which are exchangeable for common stock. Converts, as they'resometimes called, can offer more dividend income than stocks and greaterappreciation than regular bonds, although they often carry more "call"risk. When a company calls a bond, it may buy it back for less than whatyou could get by converting it into stock.

The doctor's $2.6 million bond portfolio currently returns 10.4 percent--or$270,400--a year. That covers his affluent lifestyle, while the rest ofthe portfolio rides with stocks.

How to tell when a bond's too risky

In general, the higher a bond's yield, the greater the chance the issuermay call it or default. Unproved or troubled corporate borrowers have lowcredit ratings and must give lenders more to accept their IOUs. Better operationswith sound finances borrow at cheaper rates, because lenders are confidentthat they'll be repaid.

To help investors gauge the merit of bonds they're considering, ratingagencies assign quality rankings. Standard & Poor's (www.standardandpoors.com) awards each bond a letter grade between AAA and D. AAA goes to thehighest-quality, most dependable issues. As the order descends, the bond'squality diminishes and its yield typically rises. BBB bonds just make investmentgrade. Their quality is sound at present, but the overall outlook is lesssecure. CCC bonds are even more speculative, and D-rated bonds are in default.Moody's Investors Service (www.moodys.com),the other major bond-rating agency, uses a similar letter-based scale.

When financial conditions change for an issuer, its debt usually comesup for review. Downgrades may reduce the bond's price; upgrades can havethe opposite effect. Bonds Online ( www.bondsonline.com)offers news on hundreds of issues, as well as current prices and yields.The Bond Market Association's site ( www.investinginbonds.com) features excellent primers on bonds and bond investing. News and researchon the companies that issue bonds are available at Morningstar's site (www.morningstar.com ). Knowingthe issuer's age and total assets can help you or your adviser use theseresources to distinguish quality junk bonds from garbage.

Is there an alternative to owning individual bonds?

Unless you or your adviser is very familiar with high-risk bonds, youshould let an expert who specializes in these investments select them. Ifyou'd rather not deal with that hassle, you can do quite well purchasinga bond mutual fund, which already has a fixed-income specialist in charge.

Buying a bond fund is smart because fund shareholders enjoy advantagesthat individual bondholders don't, including easy redemption, automaticdividend reinvestment, and flexibility. It also takes far less capital todiversify effectively through bond funds than with individual bonds.

On the downside, bond funds don't guarantee return of principal at somefuture date. Their prices fluctuate with market conditions and interestrates, so the risk to principal is greater than with individual bonds--thoughthis becomes less important the longer you stay in the fund. Still, bondfunds make especially good sense in the high-yield market, where diversificationis crucial to cushion against defaults.

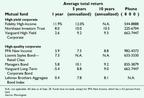

Northeast Investors Trust is a top-performing bond portfolio with a dependablefather-and-son management team. The fund charges expenses of just 0.61 percentannually--half the high-yield-bond category's 1.32 percent average--andboasts a 10.5 percent annualized return over the past decade. * Three-quartersof its portfolio is invested in bonds rated BB and B. The fund's recentreturns have been disappointing, but its long-term numbers have consistentlyoutpaced its high-yield index.

Vanguard High-Yield Corporate Fund is also a sound choice for junk bondinvestors, with a 10-year 9.3 percent average annual return and an evensmaller expense ratio than Northeast Investors': 0.29 percent a year.

Bond funds made up of investment-grade corporates can also give yourfixed-income allocation a lift. Minimizing the risk in this sort of portfolio,as with a portfolio of high-yields, means finding a manager who thoroughlyunderstands the companies that issue the individual bonds.

Dan Fuss, one of the best corporate bond fund managers around, fits thedescription. His Loomis Sayles Bond fund (institutional shares) was topsin its class over the past five years, with an 11.5 percent average annualizedreturn. Retail shares are now offered, too, but one drawback is the $25,000minimum to get in. Happily, Fuss runs a similar fund that also has beensuccessful--Managers Bond Fund--which requires an initial investment ofjust $2,000, or $500 for IRAs.

For more on these and other bond funds--as well as a list of recommendedindividual bonds--see page 116. And remember, this isn't your grandfather'sbond market anymore: You and your adviser should review your bond holdingsat least once a quarter if they make up a good chunk of your assets.

*All returns are through Sept. 30.

Aggressive bonds that can see you through retirement

*See "Surprise! Junk bonds are safer than stocks," March 9,1998, and "Earn 7 percent or more with little risk," Jan. 29,1996, (both available in our archives).

Jonathan Burton. Wake up that sleepy bond portfolio. Medical Economics 1999;21:115.