Article

UPDATE

On finance and practice

New tax law affects your wallet . . . If you donate a car to charity, your tax deduction will be limited to what it's sold or auctioned for, under the new tax law passed by Congress in October. As of Jan. 1, you'll have to produce a written receipt from the charity spelling out exactly how much it made when it sold your old clunker. Likewise, you'll need a receipt if the charity decides to keep the vehicle and use it, specifying its value. Under the old rules, taxpayers could write off the car's estimated market value, which could far exceed the price they'd actually get if they sold the car.

. . . and your practice You can write off up to $102,000 a year in equipment purchases (a figure that is adjusted for inflation through the end of 2007), but the tax loophole won't fit a sports utility vehicle anymore. The business expensing deduction for an SUV weighing more than 6,000 pounds shrinks to $25,000 from rules that allowed taxpayers to write off the total cost. The extended expense allowance for other business equipment, including certain computer software, will be indexed for inflation for the next three years.

A plug-in Internet Utility companies have a green light from the FCC to roll out broadband Internet service through the power grid. Broadband over power lines, or BPL, uses a modem that plugs into electrical outlets. The new service is already available to Current Communications customers in Cincinnati, who pay from $30 to $50 a month depending on the speed of the connection. Industry experts expect other utility companies will soon offer the technology.

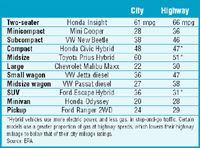

Here are the top vehicles in each class.

Turn down that thermostat Heating bills are expected to rise by up to 28 percent this winter, says the federal Energy Information Administration. The average household using heating oil will spend $1,223 from October through March, a 28 percent increase over last year's bill. The typical household heating with natural gas will spend $1,003, a 15 percent rise. Propane-heated households will spend $1,396, a 22 percent jump. You can thank higher fuel prices and projected colder-than-normal temperatures for the increase.

Are socially screened funds really different?

Apparently not as much as you might think. More than 90 percent of Fortune 500 companies have made their way into the portfolios of socially screened mutual funds, says a study by the Natural Capital Institute, a research company. The most popular picks among socially responsible mutual funds were Intel, Cisco Systems, and Johnson & Johnson.

A "socially screened" mutual fund limits its holdings to exclude companies with poor environmental, social, corporate, or labor records. But that's a broad definition; the fund industry hasn't established specific criteria for determining whether a company is socially responsible.