Article

UPDATE

On finance and practice

Don't let your finances get washed away

To find out the relative risk of flooding on your property, and to find out how to buy flood insurance, go to http://www.floodsmart.gov, a website of the National Flood Insurance Program.

Only 10 percent of adults know that they shouldn't spend more than 4 percent of their retirement savings a year to avoid running the risk of outliving their nest egg, says a survey commissioned by New York Life. Nearly 30 percent of survey respondents think they can safely spend 10 percent or more of their savings annually in retirement. At that rate, they're likely to run out of money in 11 years or less.

Don't assume you can't fight a tax penalty

Taxpayers who challenged the IRS won at least partial relief in 41 percent of the more than 102,000 appeals filed in fiscal 2004, says a Government Accountability Office report. When challenging IRS decisions such as additional taxes or penalties assessed following an audit, lucky taxpayers got anywhere from a more manageable payment schedule to a total victory. Information about the appeals process is posted at http://www.irs.gov. Click on Individuals, then Appeals under Individual Topics.

Cardholders are getting socked

The average interest rate for variable-rate credit cards has gone up more than four percentage points to 16 percent since the Federal Reserve started hiking its rates two years ago, says CardTrak. The average rate for variable-rate cards, which represent more than 82 percent of credit card accounts, was 11.6 percent in May 2004. Rates for fixed-rate cards have risen to 14.2 percent from 12.6 percent over the same two-year period.

Tougher fuel-economy standards

Minivans and SUVs will get a bit more fuel efficient beginning with the 2008 model year under new US Department of Transportation rules. Light trucks will have to get at least 22.5 miles per gallon for 2008, 23.1 mpg in 2009, 23.5 mpg in 2010, and an average of 24.0 mpg in 2011. The standard for passenger cars will remain at 27.5 mpg. The new standards will add an estimated $64 to the average purchase price of all vehicles affected in 2008, $185 in 2009, $195 in 2010, and $271 in 2011.

Heavier SUVs, such as the Hummer H2 and H3, will have to meet mileage standards for the first time in 2011. The specific standards vary by vehicle size. The H3, for example, must get at least 24.2 mpg.

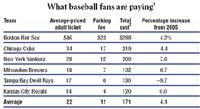

Take me out to the . . . ATM