Article

UPDATE

On finance and practice

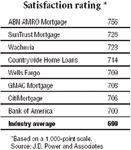

Mortgage lenders that keep customers the happiest

New ratings for retirement plan shares

Credit card balances are (gasp!) shrinking

The average level of credit card debt dropped by 11 percent last year to $2,328, down from $2,627, says Myvesta, a nonprofit consumer-education organization. Americans held an average of 2.9 cards each, the same as in 2004. Cardholders in the West have the highest average at $2,547, while Midwesterners have the lowest at $1,972. Married people carry an average of $2,625 in credit card debt, while single folks have $1,744.

How generous are folks in your state?

More investor complaints, fewer happy endings

The NASD received 4,800 customer complaints about brokers and firms in 2005, a 2 percent increase from a year earlier. But it resolved 5 percent fewer complaints over 2004. Investors who believe they've been harmed by a brokerage's unfair or prohibited business practices can file a complaint online with the Washington, DC-based organization, at http://www.nasd.com. (Under Investor Information, click on Investor Complaint Center; you can also print out a form to mail.) Prohibited practices include recommending unsuitable investments, misrepresenting material facts, switching funds without a legitimate investment purpose, and charging excessive commissions.

Primary care: On a slippery slope?