Article

Update

Practice and financial news you can use

HOSPITALS

Study: Doctor-owned facilities lacking

In response to the report, Physician Hospitals of America endorsed the Inspector General's recommendations to address the deficiencies but added that similar-sized tax-exempt hospitals should come under the same level of scrutiny. "This study is a snapshot of one small part of the hospital delivery system in this country," said PHA president Douglas Johnson.

RETIREMENT

More CPAs may offer 401(k) plans

An informal poll of certified public accountants found that more of them may get into the business of retirement planning, by offering 401(k) plans to their clients, according to a recent article in Investment News. The logic behind this is that clients already have formed a bond of trust with their CPA, most of whom already help fill out tax papers for retirement accounts.

In working with small businesses, CPAs would likely take a cautious approach to 401(k) investing, to avoid aggravating and losing a client, or would hand over the choice of investments to a professional retirement plan administrator and third-party record-keepers. "These services are well-suited to CPAs since they're a mixture of tax law, planning, and accounting," says CPA Sherman Doll of Capital Performance Advisors, in Walnut Creek, CA.

PATIENTS

Should you flaunt your fitness?

An overweight MD or DO can inspire a patient to make important lifestyle changes as readily as a physician who displays photos of his marathon finishes. But if you're a competitive athlete who's proud of your accomplishments, go ahead and let your patients know, if you're comfortable doing so. Be aware, though, that your fellow athletes can be among the most demanding of your patients. As one 60-year-old cardiologist and marathon runner told The New York Times recently, "They can drive you nuts."

PERSONAL FINANCES

Nuke the excess paperwork

As tax time draws closer, you'll be opening a pile of envelopes from your employer, bank, mutual fund companies, brokerage houses, and the like, reporting your earnings for the year. That's in addition to the usual statements and stubs you're inundated with throughout the year. To help reduce the clutter-and in some cases save money-here are a few tips from the January issue of Consumer Reports Money Adviser.

MEDICAL ERRORS

Doctors want to report their mistakes . . .

To improve patient safety, most physicians responding to a new study agreed that they should report medical errors to their hospital or healthcare organization. However, doctors feel that the current systems used to report and share information about errors are inadequate. Instead, they often rely on informal discussions with their colleagues to convey and assess these incidents, according to the study, which was funded by HHS' Agency for Healthcare Research and Quality and appears in the January/February issue of Health Affairs.

A full 83 percent of the study's 1,000 respondents-physicians and surgeons from Missouri and Washington state-said they had used at least one formal error-reporting mechanism. The most commonly used methods were reporting the mistake to Risk Management or completing an incident report. More distressing was the fact that few doctors believed that they had access to a reporting system designed to protect patients, and nearly half (45 percent) had no clue whether their organization had one in place.

. . . but insurers won't pay for them

In November 2007, we reported that more than half of US hospitals that replied to a recent survey had pledged to be accountable for "never events," vowing to report the mistake, apologize to the patient, and waive all costs related to the bad care. Following Medicare's lead, Aetna, WellPoint, and other big private insurers are now adding teeth to their hospital contracts, by including language that says the insurers will no longer reimburse hospitals for care that results in a "never event." These grave mistakes include surgery performed on the wrong body part or patient, leaving a foreign object inside a patient after surgery, or discharging an infant to the wrong person-all rare, but clearly preventable, errors.

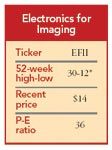

StockPick

While a blow like this is obviously disheartening, the stock presents an extraordinary opportunity for investors, primarily because the balance sheet contains more than $9.50 per share in cash. Even with recent cuts in the consensus forecast, earnings for Electronics for Imaging are still expected to be north of $1 per share in 2008. That represents solid growth. We've trimmed our three-year target price a bit, from $30 to $27 a share, but this "cash is king" print-technology supplier is worth buying any time between now and when the price reaches $15, or dips below it.

Our stock analyst is John Buckingham, the editor of The Prudent Speculator, the investment newsletter rated No. 1 for total return performance for 25 years by The Hulbert Financial Digest. Buckingham also manages the Al Frank Fund and Al Frank Dividend Value Fund, mutual funds that focus on undervalued and out-of-favor companies. *Data through Jan. 30, 2008. Source: Morningstar

OFFICE VISITS

Conversations for sale

In the name of medical research, a company called Verilogue will pay you for digitally recording your conversations with patients. Verilogue, based in Fort Washington, PA, files away these interviews in its database and then sells them to pharmaceutical companies and other healthcare businesses after removing any information that would identify patients and doctors. The stated goal is to help such companies develop more-effective medicines and services, as well as communication tools for physicians.

Doctors in the Verilogue program record their conversations with patients two days a month, asking for permission beforehand. To participate, both doctor and patient must waive any right to access the recording afterwards, says Verilogue president and CEO Jeff Kozloff. That waiver is designed to keep the recordings out of malpractice proceedings. While he won't be precise, Kozloff says Verilogue compensates doctors for their time at the market rate for activities such as taking part in focus groups and completing online surveys.

PERSONAL FINANCES

Can you live on one income?

Maybe you and your spouse are planning to start a family soon, or he or she wants to leave Corporate America to start a business. If one of you quits the work world, can you still cover your bills, save enough for retirement, and have enough left over to, say, save for your kids' college education or take a nice trip every so often? To find out, use the worksheet posted at Kiplinger.com ( http://www.kiplinger.com/tools/managing/afford.html). It covers everything you've probably already considered (mortgage, property taxes, homeowners and life insurance, retirement and education savings) and some things you might overlook (child-care costs; fees, dues, and subscriptions; and commuting costs). Input your numbers and the program will calculate your family's net monthly cash flow. If you get a negative result, go back and see where you can pare down the budget, starting with discretionary spending. You may not get to the Caribbean this year, but you can't put a price on living your dream.