Article

Stock Watch

Each month, we highlight two stocks selected as good bets by a premier analyst. The selections are based on several factors including growth potential, valuation, sector trends, competition, and dividends.

This month's guest analyst is Kelley Wright, editor of Investment Quality Trends, an investment newsletter that was rated No. 1 in risk-adjusted performance for 15 years by The Hulbert Financial Digest through Nov. 30. Wright is Chief Investment Officer of IQ Trends Private Client Asset Management in La Jolla, CA, and focuses on identifying undervalued companies with attractive dividend yields.

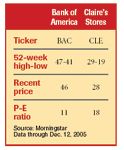

Bank of America

Figures for the third quarter of 2005 are especially encouraging. They showed double-digit revenue growth across all business segments, strong performance in credit card services, and a 10-percent increase in average retail deposits. Its acquisition of FleetBoston last year coupled with the recent MBNA merger announcement provide strong opportunities for additional growth. In particular, MBNA's portfolio should provide a healthy boost to Bank of America's credit card holdings, and make it a more-formidable competitor to Citigroup's Citicard program. Plus, notes Morningstar, since its product lines are skewed toward consumers and small businesses as opposed to large corporations, its results are less volatile and credit quality more predictable than those of banks that cater to large corporations.

Unlike many other stockpickers, Wright doesn't look to earnings as a barometer of value; instead, he feels dividend yield best defines the company's financial health. "Dividends can't be faked or altered; the money is either in the bank or it isn't," he explains. "We prefer that the percentage of earnings paid out in the form of dividends be 50 percent or less, to protect the dividend in case the company hits a rough patch." Bank of America makes the cut with 49 percent.

Furthermore, Wright sees the recent announcement of a dividend increase, especially when factored in with Bank of America's price, as an excellent sign. He feels the company is undervalued until it reaches approximately 46 per share, and overvalued at 118 or so. At its current price of 46, that means it has lots of room to run.

Claire's Stores

Claire's is a specialty retailer that sells costume jewelry, earrings, hair ornaments, and other fashion accessories in a total of more than 3,000 stores. Its original store concept, Claire's Accessories, targets 7- to 17-year-olds and is located primarily in malls in North America, as well as in parts of Europe, Africa, Japan, and the Middle East. The company's other store concept, Icing by Claire's, sells the same type of merchandise to the 17- to 27-year-old market in more than 400 North American stores.

Recently named one of the best-managed companies in America by Forbes and a hot growth company by BusinessWeek, Claire's pays out 27 percent of its earnings in dividends and has increased dividends at least 10 percent a year, on average, over the past 10 years. The conservatively run company maintains no long-term debt, and Wright feels the stock represents a good value up to a price of approximately 30 a share, with a whopping 286 percent to go before it reaches the point of being overvalued at about 80.