Article

Stock Watch

Each month, we highlight two stocks selected as good bets by a premier analyst. The selections are based on several factors including growth potential, valuation, sector trends, competition, and dividends.

This month's guest analyst is Richard Moroney, editor of Dow Theory Forecasts, an investment newsletter that was rated No. 5 for total return performance for 25 years by The Hulbert Financial Digest through Oct. 31. He's also Chief Investment Officer of Horizon Investment Services, a registered investment adviser headquartered in Hammond, IN.

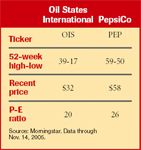

Oil States International

Moroney gives the company high marks for beating share-price and earnings expectations. "Oil States should be able to top consensus growth projections of 24 percent per share for 2006," he says, "and the company seems capable of 20 to 25 percent annualized growth over the next 5 years."

Increased drilling activity and price hikes are helping each of Oil States' divisions. Per-share earnings for the company overall surged 74 percent on a 62 percent sales gain in the first half of 2005, and replacement demand in the hurricane-ravaged Gulf of Mexico should boost the need for its products. With niche acquisitions complementing attractive positions in fast-growing markets, Oil States is outperforming its peers and is likely to pursue more deals over the next three years.

PepsiCo

There's a lot more to this company than soda pop. In fact, the consumer goods behemoth boasts 16 brands that generate at least $1 billion each in annual retail sales and make PepsiCo a top choice among large-company growth stocks that are likely strong enough to weather a market downturn. "Analysts predict over 10 percent annual growth in profits for the next five years," says Moroney, "but strong cash flow and a solid balance sheet should allow the company to pursue acquisitions that will help it exceed these targets."

The company has four business segments-Frito-Lay North America, PepsiCo Beverages North America, PepsiCo International, and Quaker Foods North America-and a great track record of creating innovative products to adapt to changing consumer tastes. To offset a reduced preference for soda in favor of water, tea, juice, and energy drinks, for example, it amassed a broad portfolio of noncarbonated-beverage brands, such as Aquafina water and the sports drink Gatorade. Frito-Lay also responded to consumer demand for healthier snacks by producing a line of lower-fat products, and it delivered 6 percent revenue growth in the first half of the year.

PepsiCo International did even better over the same time period. Jumps in snack-food and beverage volume contributed to a 14 percent boost in foreign revenue and a 21 percent increase in operating profits. The company as a whole has increased its dividends in each of the last 33 years and plans to repurchase $3 billion in stock this year. "Buybacks reduce shares outstanding, providing a boost to share prices," Moroney explains, "and signal that management is interested in returning cash to shareholders."