Article

Stock Watch

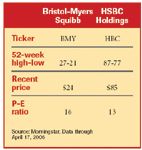

Each month, we highlight two stocks selected as good bets by a premier analyst. The selections are based on several factors including growth potential, valuation, sector trends, competition, and dividends.

This month's guest analyst is Charles Allmon, editor of Growth Stock Outlook, the only newsletter that hasn't lost money in any calendar year among those with a record of 20 years or longer, as tracked by The Hulbert Financial Digest. Allmon is also president of Growth Stock Outlook, a money management firm based in Bethesda, MD.

Bristol-Myers Squibb

Although earnings have been down the past few years, largely due to litigation troubles, the company expects to be back on the growth track by next year. Higher dividends, too, are also anticipated.

"The pipeline might be the best and most diversified of all the major pharmaceutical firms," says Allmon. To offset patent-exclusivity losses, Bristol-Myers has started to develop a new crop of drugs geared toward serving unmet medical needs in the areas of affective (psychiatric) disorders, Alzheimer's/dementia, atherosclerosis/thrombosis, diabetes, hepatitis, HIV/AIDS, obesity, oncology, rheumatoid arthritis and related diseases, and solid organ transplant. Six of those drugs have already received FDA approval since late 2002. One drug-Orencia, which is indicated for the treatment of rheumatoid arthritis-received approval last December.

"Two or three of these drugs are bound to be big hits," predicts Allmon. "The com-pany has divested itself of less-profitable opera-tions, and its problems are pretty much behind it."

HSBC Holdings

Last year, total revenues for HSBC USA alone increased by 23 percent and deposits were up 15 percent. These outstanding results were partially due to strong credit quality; the bank is ranked highly by three top credit-rating agencies. Operations in 76 countries and territories in Asia, Europe, the Middle East and Africa also help to cushion the company in case one or more regions experiences a downturn.

The banking standout is "obsessed with providing superior service, determined to cut unnecessary costs, and focused on economic profits and total share-holder returns," according to Morningstar's analyst report, all of which boosts the attractive ness of its shares. Earnings per share are expected to grow by about 10 percent per year through 2009. The report goes on to note that strategic acquisitions have given it a "footprint in fast-growing markets such as US subprime lending, Asian mortgages, and Chinese insurance businesses."

Allmon, however, is especially drawn to HSBC because of its healthy 4.3 percent dividend yield, the ultimate hallmark of a company's financial footing, and a sign of its willingness to spread the wealth among shareholders. "HSBC has solid profit margins and a strong track record," says Allmon. "All in all, it's a smart long-term investment."