Article

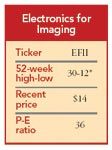

Stock Pick: Electronics for Imaging

California-based Electronics for Imaging is a leader in the field of print-server technology.

While a blow like this is obviously disheartening, the stock presents an extraordinary opportunity for investors, primarily because the balance sheet contains more than $9.50 per share in cash. Even with recent cuts in the consensus forecast, earnings for Electronics for Imaging are still expected to be north of $1 per share in 2008. That represents solid growth. We've trimmed our three-year target price a bit, from $30 to $27 a share, but this "cash is king" print-technology supplier is worth buying any time between now and when the price reaches $15, or dips below it.

Our stock analyst is John Buckingham, the editor of The Prudent Speculator, the investment newsletter rated No. 1 for total return performance for 25 years by The Hulbert Financial Digest. Buckingham also manages the Al Frank Fund and Al Frank Dividend Value Fund, mutual funds that focus on undervalued and out-of-favor companies. *Data through Jan. 30, 2008. Source: Morningstar