Article

Lifecycle funds: set it and forget it

Author(s):

Your Money

After 35 years of practice, investing and finance still excite me. But I realize they're not everyone's cup of tea.

Some doctors flirted with investing in the late '90s, when the stock market was white hot. But since the 2000 market plunge, many of my physician clients have confessed that they now want little or nothing to do with investing. Many disenchanted investors have headed for financial advisers; others have become interested in the decision-free approach offered by lifecycle mutual funds.

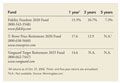

If you're going to buy a lifecycle fund, look for a large investment house with an assortment of funds it can utilize. Slim pickings could mean you'll get stuck with lackluster performers. While many companies offer lifecycle funds, I think your best choices boil down to Vanguard Target Retirement Funds, Fidelity Freedom Funds, and T. Rowe Price Retirement Funds. (For a glance at how some of them have performed in recent years.) Between them, these three companies offer lifecycle funds with target retirement dates in five-year increments, from 2000 through 2050.

Like Burger King vs McDonald's, there are differences despite outward similarities. Vanguard's lifecycle funds generally contain five funds each; T. Rowe Price's Retirement Funds have about 13 to 15 underlying funds; and, on the high end, Fidelity Freedom Funds each contain around 25 of the company's funds. In general, more funds give you more diversity and may dampen volatility, but in these cases, the risk profiles are generally similar.

Compare expenses, too; they can drain returns like a leaky pipe. Each underlying fund has management expenses, and the fund companies sometimes add on another charge for the total fund. The Big Three companies' expenses are reasonable, though. For example, expenses for a 2025 target fund are: Fidelity (0.75 percent), Vanguard (0.2 percent), and T. Rowe Price (1.15 percent). All are no-load, meaning you won't pay a commission to own them. The average lifecycle fund's expense ratio is 1.35 percent. Vanguard's the undisputed king of low-cost funds, which is why its lifecycle fund has such a skinny ratio.

Lest I make lifecycle funds sound too much like a magic panacea, I have a couple of cautions. While it would be nice to think that you can satisfy all your investing needs with one fund-even a fund of funds-I think that's a stretch. It's smarter to spread your bets and get lifecycle funds from two or three companies. Also, think about your individual financial situation. When you're choosing the target retirement date, one size may not fit all. If you have a sizable nest egg and expect to leave money to your children, you may have to get more aggressive than the stock/bond allocation suggested for your age category. Lifecycle funds are not as good as a well-executed asset allocation that selects funds from many fund families.

The author, a fee-only certified financial planner (CFP), is president of L.J. Altfest & Co. ( http://www.altfest.com), a financial planning and investment management firm in New York City, and an associate professor of finance at Pace University. The ideas expressed in this column are his alone, and do not represent the views of Medical Economics. This column appears every other issue. If you have a comment, or a topic you'd like to see covered here, please submit it to Investment Consult, Medical Economics, 123 Tice Blvd., Suite 300, Woodcliff Lake, NJ 07677-7664. You may also fax your question to 201-690-5420 or e-mail it to meinvestment@advanstar.com

.