Article

Investing: Indexes with a twist

Why buying enhanced ETFs may be one of the smartest moves an investor can make.

But first a little background on regular ETFs-what they are and how they work. First introduced in 1993, ETFs track an index but, unlike index funds, they trade like a stock on an exchange; you can trade them any time during the day, as opposed to funds, which trade at the market's close. A real plus for ETFs is the low expense ratios-about 0.43 percent compared to index funds' 0.75 percent-since there's little cost from trading or shareholder services like record-keeping.

They also have tax advantages. Unlike index funds, when shares are redeemed, ETFs don't require that securities be sold to generate cash for that redemption (which would result in capital gains for the other shareholders). Instead, a direct in-kind transfer is made in the marketplace, where one group in the underlying index is swapped with another group, so there are far fewer capital gains distributions.

The new universe of ETFs

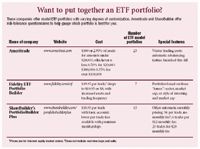

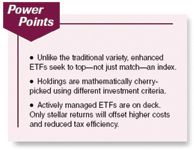

It became clear a few years ago, however, that ETFs had an inherent limitation: They could only track-not beat-the passive benchmarks. So a more sophisticated, or enhanced, ETF was created to allow investors to benefit from stock selection at the index level while capitalizing on the low cost and tax efficiency of the traditional ETF structure. Longtime ETF provider Barclays Global Investors has two enhanced products designed to do just that, while relative upstart PowerShares Capital Management has pushed the envelope even further with a unique methodology and benchmark called the Intellidex index.

Each quarter, the Intellidex dynamic indexes evaluate the 2,000 largest stocks and then mathematically cherry-pick holdings using 25 different investment criteria. They're designed to temper the risk in traditional indexes that give too much weight to stocks with the greatest market cap (share price multiplied by the number of shares outstanding).