Article

Funds of the Month

Mid-caps

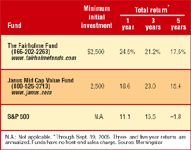

Great returns, low expenses. It's not a pipe dream, but you have to do some hunting to ferret out a mutual fund that lives up to both those descriptors. We looked among US equity funds and focused on mid-caps because those size companies (with between about $1 billion and $9 billion in assets) have been steaming ahead in recent years. Of the funds we're featuring, both have thrashed the S&P 500 Stock Index, for one, three, and five years, and their annual expenses are well below the average of 1.4 percent for domestic equity funds. Either choice could work well as the mid-cap stock allocation in your portfolio.

Options

The Fairholme Fund. Despite its impressive returns, this isn't a household name among individual investors, although it is beginning to get noticed. Portfolio co-manager Bruce R. Berkowitz took first place in the 2005 annual Barron's/Value Line survey of fund manager performance. Also, the fund ranks in the top 2 percent among its peers over the past five years, and has kept its expense ratio at 1 percent.

Another investment, Canadian Natural Resources, is taking steps to replace its shrinking natural gas reserves with large reserves of heavy oil, which has lower value and costs more to refine. Still, the market thinks the company's taking the right steps, as its share price is up 123.5 percent year to date.

Janus Mid Cap Value Fund-Investor Shares. Despite its striking recent returns, the beauty of this fund is more than skin-deep. The managers take reasonable (not aggressive) positions in out-of-favor companies. It also remains well diversified, with 138 holdings, although it currently has a larger-than-usual energy stake. But even if the energy sector pulls back, the fund has ample opportunity to shine with other winners.

Despite an influx of cash into the fund-from $948 million in assets in 2002 to $5 billion in 2005-the fund managers are doing everything they can to continue the strong performance. Four new analysts were hired in 2004; plus, the fund is holding about 13 percent of assets in cash, waiting to spring at the right opportunity. And its expense ratio is a trim 0.94 percent.