Article

Are cash-back cards worth it?

Here's what to look for and what to avoid in rebate cards.

Before you start investigating which is the right card for you, ask yourself one all-important question: Do I pay my credit card bill in full each month? If the answer's No, you'll need to rethink your credit card usage before signing up. Greg McBride, Bankrate.com's senior financial analyst, notes, "The rebate you're getting may be 1 to 2 percent of the purchase, but the interest rate you'll pay on the card is 12 or 13 percent, if you're lucky." What you'll pay on any balance carried over from month to month on a rebate card will more than wipe out any money you get back. So if you typically carry a balance, shop for a low-interest-rate offer instead, and look into cash-back only for your secondary card and only if you use it for purchases you'll pay off immediately.

If you do pay your bills in full and on time, start digesting the fine print, keeping in mind how often-and for what amounts-you'll use a rebate card. A light spender should avoid the few cards out there with annual fees, since these could easily eat up half the rebate. On the other hand, a big spender may be better off paying the annual fee on a card that rewards high-level charging. This would include, say, a solo physician who's used to putting a lot of expenses for office supplies on a credit card.

Lastly, which card will give you the most bang for your buck based on your regular purchase patterns? Remember that your best deals include the restaurants, stores, and gas stations you'd be spending at whether or not you get a rebate.

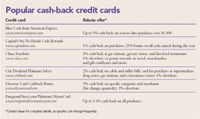

Since no two card users are alike, no one card is best for everyone. To find a variety of recent offers, visit Bankrate.com ( http://www.bankrate.com/brm/rate/cc_home.asp) and CreditCards.com ( http://creditcards.com/cash-back.php). Some issuers are touting flexibility: You can switch from reward points to gift cards to cash back, whenever you like. However, many offers made in connection with specific retailers change frequently. Be sure to check the details before signing up.

One last caveat: Using a charge card just to get cash back could turn into a nasty spending habit. Only buy what you truly need and never purchase something just to get the rebate reward-it's just not worth it.