Article

5 golden rules of estate planning

Failing to plan correctly can become a plan for failure.

To help you out, we've consulted top estate-planning experts who listed for us five of the most common errors that have the greatest potential to deplete your beneficiaries' inheritance, create intrafamily upheaval, or land your loved ones in court.

1. Not using the estate tax exclusion-twice

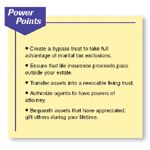

The Economic Growth and Tax Relief Reconciliation Act of 2001 provides that an individual can leave to heirs other than a spouse up to $1.5 million free of federal estate tax. (This is the estate tax exclusion, which is slated to rise to $2.0 million in 2006 and $3.5 million in 2009.) But for both spouses to take advantage of this exclusion, the first one to die has to create an exemption trust-also called bypass trust-where the trust is named the owner and the spouse or children are named beneficiaries.

Here's the wrong way-and the right way-to do this:

Scenario A: Harry dies, leaving $3 million to his widow, Sally. A year later, Sally dies. The $3 million estate is passed directly to their two adult children, who are left with only the $1.5 million exclusion from Sally's estate. They must pay a federal estate tax of $695,000, or about 46 percent of the nonexcluded $1.5 million. Since Sally had directly inherited all of Harry's money, his estate lost the ability to shelter $1.5 million of his estate when it eventually passed to his children.

Scenario B: Harry leaves $1.5 million of his assets to an exemption trust and names Sally as a trustee. He leaves her another $1.5 million outright. Since the trust assets do not pass to Sally directly, once she dies, her children receive both the trust's and her assets. So they'd be entitled to take exclusions from both their parents' estates-$1.5 million each-meaning that the entire $3 million estate would pass tax-free.

The tax benefits of an exemption trust are even greater: Any appreciation on assets in the trust will be estate-tax-free on the second spouse's death; however, the children will have to pay capital gains taxes when they sell the assets, based on their value at the time the first parent died. This year, beneficiaries can receive even more than $1.5 million free of federal estate tax. (Bear in mind that a state's estate tax can take its toll on an estate. State laws vary greatly, so it's best to consult an estate-planning attorney in your state.)