Article

14 deductions you might miss

The best accountant in the world can miss writeoffs you don't tell her about. Here are 14 that often get overlooked.

Yes, you have a terrific accountant you've worked with for years. She makes sure you take all the deductions you're entitled to. But she's not a mind reader. If you fail to mention an item, she may miss it, too. Think of it this way: Can you accurately diagnose a patient if he doesn't tell you all his symptoms? To jog your memory, here are some deductions that doctors frequently overlook.

Practice equipment

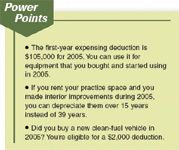

Did you purchase equipment for your practice last year, like office furniture, computers, or off-the-shelf software? Provided you started using the equipment in 2005, it qualifies for special treatment. So don't forget to turn over the receipts to your accountant.

However, if your business use is less than 100 percent, but more than 50 percent, the expense deduction is limited to the business portion of the cost. (So, for example, if you made a purchase of $11,000 and only used it for business 80 percent of the time, your first-year deduction would be limited to $8,800.) If your business use is 50 percent or less, you won't be able to use the first-year expensing election at all.

SUVs

Did you buy a heavy SUV (defined as weighing more than 6,000 pounds) for your practice in 2005? It's still possible to get a partial deduction on it. You can expense as much as $25,000 of the cost, and you're allowed regular depreciation, as well. For instance, if you paid $65,000 for your SUV, you'd deduct $25,000 immediately and you'd get a regular depreciation deduction of 20 percent of the remaining $40,000 (or $8,000). So your total first-year writeoff is $33,000. You'd recover the remaining $32,000 in 2006 and subsequent years under the general depreciation rules.

Remodeling an office you rent

If you rent your office and remodeled it in 2005, you can take advantage of a special 15-year depreciation schedule. (Normally, these improvements must be depreciated over 39 years.) Remember, these "leasehold improvements" must be interior improvements, and the improvement must be made more than three years after the building was first placed in service.

Improving an office you own

If you own your office building (or if you have a medical condominium), you also might be able to get a tax break for remodeling.

"Many tax preparers mistakenly lump together all expenses incurred in the remodeling, expansion, or construction of an office building," notes Richard A. Blum, a CPA and attorney with Elliot & Warren in Charlotte, NC. "They then use straight-line depreciation over 39 years for the entire construction expense." But some of those costs could qualify for faster depreciation if the work is considered "nonstructural" improvements.